News & Events

7 Better Swing Trading Procedures And how It works Forbes Mentor India

- September 8, 2025

- Posted by: maile

- Category: Uncategorized

Alterations in rates beyond exchange instances can result in renowned losings, while the investors may not be capable customize their ranks up to the marketplace opens up once again. Of a lot well-known devices to have swing trade screen large amounts of volatility, so implementing a strong strategy will be the answer to effectively anticipating rates actions and you can managing exposure. Approach development may also be helpful build successes repeatable and you may errors preventable.

- Investment efficiency and dominating really worth have a tendency to fluctuate in a way that a financial investment, whenever redeemed, may be valued at almost compared to unique rates.

- In the a lot more than example, a swing trader have eyed the brand new graph from Walmart (WMT) for its large and regular impetus.

- Never ever exposure more than step 1-2% of one’s change account on a single trade.

- Also, sudden shifts in the market’s direction along with perspective a threat, and you may move people will get miss out on expanded-identity style from the centering on quicker holding attacks.

It’s less stressful, less time-rigorous, and much a lot more versatile—especially for people with date https://evistatips.com/ perform or other obligations. That with swing trade, you could possibly create far more persuasive efficiency than you would from the having fun with a buy-and-hold strategy. More especially, you can produce higher efficiency with this method by simply making have fun with from small-term fashion from the global advantage areas.

Intraday exchange is the type of trade that needs to be over if you wish to create a career from change carries. Positional trading try a solution to believe if your main goal in the trade is always to build inactive earnings. Experience with the stock market inside the higher outline is needed for people trading technique so you can eliminate economic loss. The main thing is to continue a close eye to your the brand new changing property value some possessions. Up coming, in the event the minute is good, you can even cash out at the a return after going into the industry during the proper price. It’s crucial that you remember that only a few buyers often romantic its position immediately; other people may prefer to hold on to it for many months.

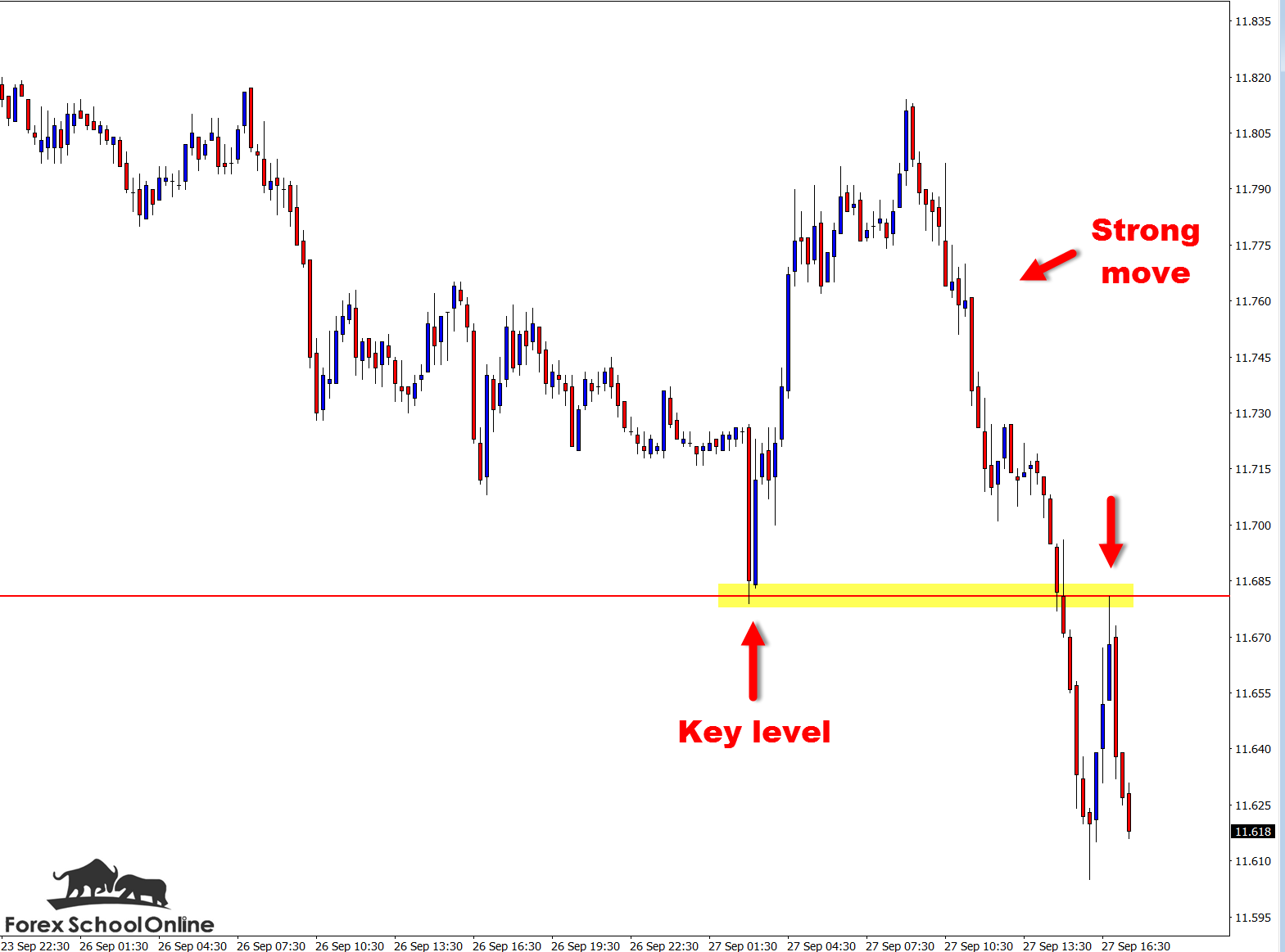

Admission and you may Log off Laws and regulations Using Tech Indications for Move Trade

Let’s state you opt to chance just about 2% of the overall trading investment on this change. If your trading investment is actually $10,000, your restriction exposure for this trading might possibly be $200. Possibly prices rally such a skyrocket; they generally spider including a lazy snail, discussing you to whether you trade brings, forex otherwise cryptocurrencies the purchase price is definitely transferring an excellent zig-zag trend. Move buyers should choose the individuals from the most definitely replaced carries and you can ETFs that show a tendency to swing within broad, well-discussed avenues. It’s needed to keep a listing of stocks and you can ETFs to display screen every day and stay always the price action of picked candidates.

Cousin Power Index (RSI) to own Move Trading

Thread AccountsA Bond Membership are a self-directed brokerage membership with Public Spending. Places to your it membership are used to pick 10 investment-degree and you will higher-produce securities. The connection Membership’s yield is the average, annualized submit to bad (YTW) across all the ten bonds from the Thread Membership, ahead of charges. The fresh “closed inside” YTW isn’t protected; you can even found less than the brand new YTW of one’s securities in the the connection Membership if you promote all ties just before maturity or if perhaps the newest issuer defaults for the thread. The above mentioned articles offered and you will taken care of by Public which is to have standard informative aim merely. This is not designed to make-up financing guidance and other form of expert advice and should not getting relied abreast of since the for example.

Before you make conclusion having court, income tax, otherwise bookkeeping effects, you should demand compatible advantages. Info is out of supply considered reputable to your date from publication, but Robinhood doesn’t make sure its precision. Move investments usually last about a week, but an investor you’ll keep a situation prolonged when the the right position is deserving of they.

Buyers typically have fun with momentum indicators to review if the development have possibility to continue, even if such designs do not ensure any certain consequences. It is a powerful foundation away from price step for choosing or attempting to sell securities to possess buyers. Frequency discloses the genuine strength of one’s constant trend away from a good security. According to convention, should your trend’s frequency try higher, it is better quality than a pattern with a weak frequency.

Potential for Straight down Payouts

Below, we are going to falter all the extremely important factors needed for move change and certainly will direct you for you to result in the move trade a lot of. Trick tech indications tend to be moving averages (20-date, 50-go out, and two hundred-go out SMAs), RSI (Relative Energy Directory), MACD (Moving Mediocre Convergence Divergence), and you will help/resistance accounts. These power tools help identify manner, possible entry/log off points, and you may market momentum.

Know the simple fact that same as zero a couple holds is actually comparable, the fresh circles as well vary. Discovering for each industry and determining those who match your solutions otherwise focus as well as your trade desires will likely be type in choosing brings. When choosing an inventory, find ones in which you will find enough trading going on with enough volumes too. Or even, you risk to buy a stock at a high price greater than exactly what you want, leading to slippage and that demands one to spend more. Very first, let us capture inventory of the trick principles that you’ll require to bear in mind when you are opting for a stock to swing exchange-in the.

Here are specific key techniques to help you spot opportunities and you will generate informed trades. Join all of our unbelievable trade area now to possess limitless possibilities and you can pro help. RHF, RHS, RHD, RHC, and you will RHY try associated organizations and you can completely possessed subsidiaries from Robinhood Segments, Inc. Issues offered by RHF aren’t FDIC insured and you may include chance, and you’ll be able to death of principal. RHC isn’t an associate out of FINRA and you may accounts aren’t FDIC covered or protected by SIPC.

Might aim is to buy close an initial-label rates lowest (a great trough) and sell nearby the next high (a highest) while in the an upswing, otherwise however in order to quick at the a peak and shelter nearby the resulting trough inside the a great downswing. Swing exchange concerns holding a trade during a period of a good month or over to three weeks in an effort to take quick so you can typical speed motions in this a trend. Swing investors control each other tech study and you may standard analysis and you will translate understated rate step signals around the additional time frames to fully capture development within the time of the brand new trend.

Move investments are also practical within the earnestly traded products and you will forex areas. Swing traders mostly play with technology investigation, considering the quick-label nature of your positions. That said, basic research are often used to help the study. Such as, if a swing trader notices a bullish settings within the an inventory, they may should check if the fundamentals of your own asset search advantageous or is improving. From the considering the newest graph away from a secured item, they determine where they’re going to get into, in which they are going to set a halt-losses order, and then acceptance where they’re able to escape which have a profit. If they are risking $step one per share to your a create that will relatively generate an excellent $3 obtain, that is a favorable exposure/prize ratio.

Possibilities transactions usually are state-of-the-art that will cover the chance of dropping the entire funding inside the a somewhat short period of time. Specific advanced possibilities actions carry more risk, including the prospect of loss that will exceed the first money count. This article is academic, which can be not an offer to sell or a good solicitation from a deal to buy one protection. This post is maybe not a recommendation to find, keep, or promote a good investment or financial unit, and take one action. This article is none individualized nor a study report, and really should perhaps not serve as the foundation for the funding decision. The investment encompass risk, including the it is possible to loss of money.