News & Events

What Is Underapplied vs Overapplied Overhead in Budgeting?

- October 26, 2021

- Posted by: maile

- Category: Bookkeeping

By doing so, the gross profit and net income figures on the income statement are corrected, providing a more accurate representation of the company’s profitability. At the end of the year, with the full benefit of hindsight, the company knows what its actual factory overhead expenses have been. Since the company charged off only $288,450, it has “underapplied overhead” of $11,550. If the actual overhead had come to $270,000, the company would have charged off more than was necessary, and it would have “overapplied overhead” of $18,450. Note that the preliminary estimate of overhead costs, $250,000, doesn’t factor in here. In cost accounting, managing overapplied overhead is a critical task that can significantly influence an organization’s financial health.

Products

This means management can’t wait until the end of the period to add up all of the overhead costs incurred and allocate them to each job. Instead, management needs to estimate the future overhead costs and allocate them throughout the production process. As noted above, underapplied overhead is reported on a company’s balance sheet as a prepaid expense or a short-term asset. In order to reconcile this, the company’s accounting department generally inputs a debit by the end of the year to the COGS section and a credit to the prepaid expenses section.

Example of Overapplied Overhead

This is referred to as an unfavorable variance because it means that the budgeted costs were lower than actual costs. Put simply, the business went over budget making the cost of goods sold more than expected. A journal entry must be made at the end of the period to reconcile the difference between the estimated amount and the actual overhead costs. In this case we would, debit the factory overhead account and credit the cost of goods sold account for the difference. Another strategy involves leveraging technology for real-time data analysis and monitoring.

OpenStax

- This is referred to as an unfavorable variance because it means that the budgeted costs were lower than actual costs.

- This can distort the true financial position of the company, as the assets on the balance sheet appear more valuable than they are.

- Over the long-term, the use of a standard overhead rate should result in some months in which overhead is overapplied, and some months in which it is underapplied.

- To determine applied overhead, the company needs to know its budgeted overhead and actual overhead.

- In this book, we assume companies transferoverhead balances to Cost of Goods Sold.

- To adjust for this, an entry is made to debit the manufacturing overhead account and credit the cost of goods sold (COGS) account.

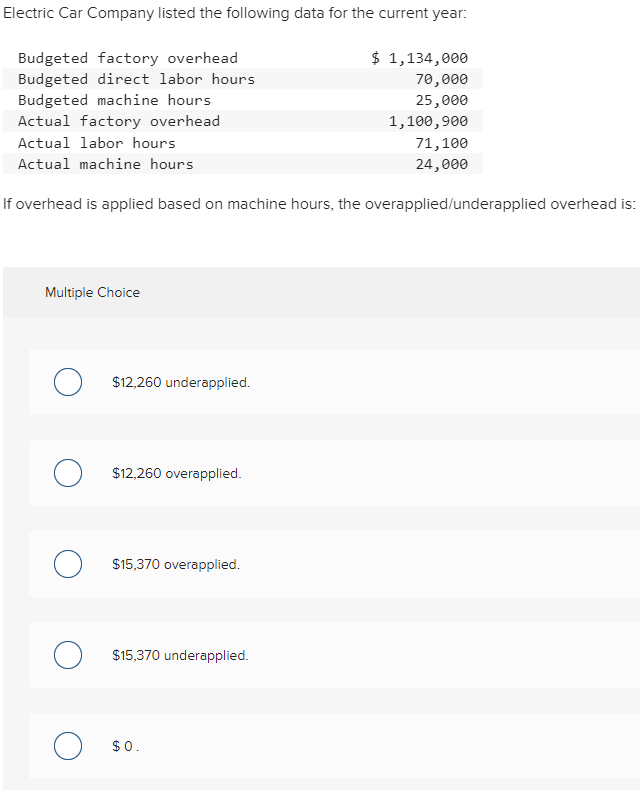

To determine overapplied overhead, one must first understand the components involved in overhead allocation. Overhead costs include indirect expenses such as utilities, depreciation, and maintenance, which are not directly traceable to specific products. These costs are allocated to products using a predetermined overhead rate, often based on direct labor hours, machine hours, or another activity driver. This rate is established at the beginning of the accounting period based on estimated overhead costs and estimated activity levels. Sometimes the estimate is more than the actual amount and sometimes it’s less than the actual amount. Overapplied overhead happens when the estimated overhead that was allocated to jobs during the period is actually more than the actual overhead costs that were incurred during the production process.

This proactive approach helps in making necessary adjustments before the end of the accounting period, thereby minimizing the impact on financial statements. Advanced software tools like SAP and Oracle can facilitate this process by providing real-time data and analytics, what is a simple tax return enabling more informed decision-making. For a company engaged in manufacturing, determining the value of inventory can be complicated. The company must account for the raw materials used in making its products, the direct labor required and any manufacturing overhead.

Overapplied Overhead Definition Becker

In a sense, the production managers came in “under budget” and achieved a lower overhead than the cost accountants estimated. In this case, XYZ Corp. will need to make an adjustment to its accounting records to account for the overapplied overhead. This could involve decreasing the cost of goods sold, or adjusting other inventory accounts depending on the company’s accounting policy. This will ensure the company’s financial statements accurately reflect the actual overhead costs incurred during the period.

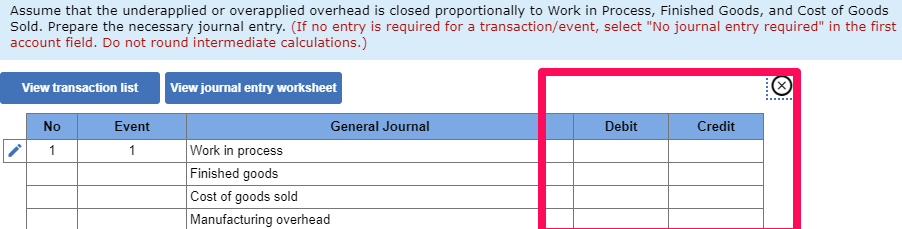

Addressing underapplied overhead involves adjusting journal entries to increase COGS and inventory values, thereby aligning them with actual costs. This adjustment ensures that financial statements accurately reflect the company’s expenses and profitability. Regular variance analysis and monitoring are crucial for identifying and correcting both overapplied and underapplied overhead. By maintaining accurate overhead allocation, companies can improve their financial reporting and make more informed strategic decisions. Adjusting journal entries are necessary to correct the financial distortions caused by overapplied overhead.

On the other hand, if the manufacturing overhead has a credit balance it means that that the applied overhead is more than the actual overhead. In this case, if the manufacturing overhead has a debit balance it means that that the applied overhead is less than the actual overhead. The presence of overapplied overhead can significantly alter the presentation of an organization’s financial statements. When overhead is overapplied, it means that the cost of goods sold (COGS) is understated, leading to an inflated gross profit.

Overapplied overhead, on the other hand, occurs when a company has overhead costs less than its budgeted costs. To determine applied overhead, the company needs to know its budgeted overhead and actual overhead. Companies use overhead analysis to determine their efficiency during a period of controlling overhead costs. Overapplied overhead occurs when the total amount of factory overhead costs assigned to produced units is more than was actually incurred in the period.

This will result in an excess charge of $15,000 to the cost of goods sold, if the situation is not corrected. To do so, the company’s controller debits the manufacturing overhead cost pool for $15,000, while crediting the cost of goods sold account for the same amount. The result is a cost of goods sold that incorporates only the actual overhead costs incurred during the month of March.

These entries ensure that the financial statements accurately reflect the company’s actual costs and financial position. The process begins by identifying the amount of overapplied overhead, which is the difference between the allocated overhead and the actual overhead incurred. Once this amount is determined, it must be removed from the accounts where it was initially applied.